Abstract

When we compare the two assets, first thing we need to be clear, Property is tangible asset and shares are intangible asset, which leads to conclusion that they are totally different assets. But you may ask why I put the together and compare it. The answer is as follows.

New prospective of Shares and Property

I want to borrow a concept from the mining industry, OPEX vs CAPEX. OPEX is the ongoing cost for running a product, business or system, and CAPEX is the cost of developing or providing non-consumable parts for the product or system. Based on the definition, I will say that Shares is Low OPEX and Low CAPEX, and to the opposite the property is High CAPEX and High OPEX. The reason as listed:

- Shares

- For ASX, you need to purchase minimum of $500 worth of share in one transaction. (LOW CAPEX)

- There is no running cost for holding the share.

- You may have to pay 30% tax on capital gain and tax on dividend if it is not fully franked(LOW OPEX)

- Property

- Minimum deposit is 20% otherwise you need to pay LMI, base on the current (June 2017) Melbourne and Sydney median house price, 1 million, you need at least 200K or 100K if you are willing to pay LMI which can be borrowed from Bank. (High CAPEX)

- Stamp duty is another initial cost for property investors, 40K for 1 million property details you can check this link, although there is reduction on stamp duties for first home buyers but not for investors unfortunately. (High CAPEX)

- For the tenant in the property, there are always running cost on it, repairs, electrician, plummer etc. Right and there are council fee, strata fee and land tax if you are lucky. (High OPEX)

Risk and market reaction

Since the property is tangible and the essential need for people living, the bubble could end up bigger than shares bubble, specially in Australia which the population is increase rapidly in the major cities. If you see risk from risk aversion angle, risk is different from everybody’s view. Shares’ market reacts quicker than property market because the players are less, big investors could easily manipulated by some news or affected by projection of the market and it can spread quickly, this is why we see lots of sharp drops in shares market. The only time you see house market drop is the GFC, but Australian market is exception. On the other hand, the reason could be that it is very unique market, negative gearing, low house inventory etc. But in long run, 5 years above, they are still safe assert to hold.

Long term return

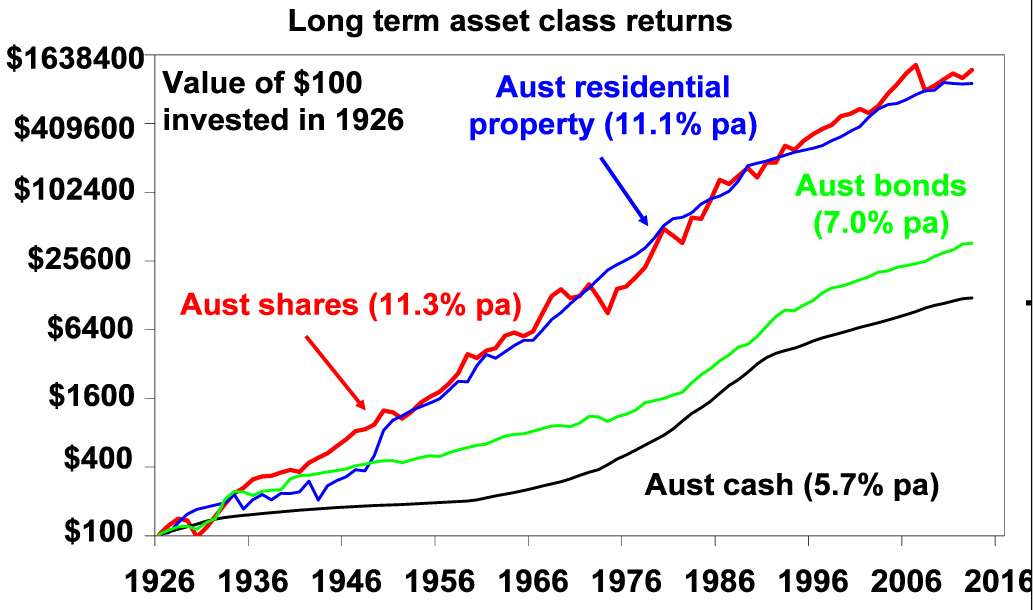

The following picture illustrates that the long term return on Australian assets.

I want to point this out, even that Shares and property are different in many aspects but from the picture we can see the long term return is reflectively the same.

Conclusion

In conclusion, no matter what kind of asset you want to invest, investment is the key point which can bring in individual financial freedom in long run. For young generation, Shares may be a good starting point. Put the money in the bank is no use for it purpose.

Quotes:

ASX research on long term investment

NSW scraps stamp duties for first home buyers